Table of Contents

ToggleUnderstanding Startup Funding Options

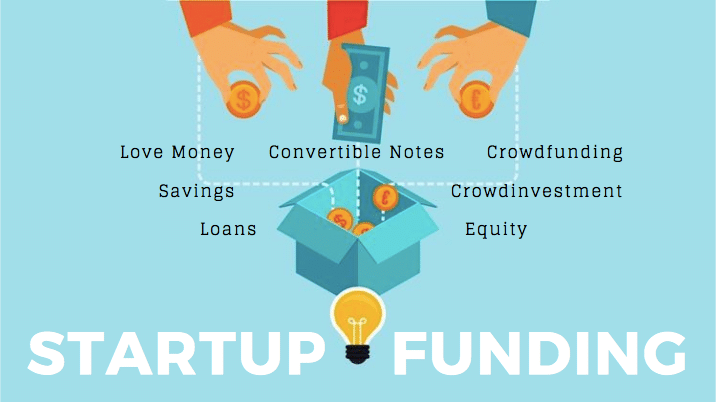

Before diving into the tips, it’s important to understand the different types of startup funding options available to entrepreneurs:

-

Bootstrapping: This involves using your own savings or personal funds to finance your startup. While it allows you to retain full control of your business, bootstrapping can be risky and may limit your ability to scale quickly.

-

Angel Investors: Angel investors are individuals who invest their personal money in early-stage startups in exchange for equity or convertible debt. They often provide not just capital but also mentorship and networking opportunities.

-

Venture Capital (VC): Venture capital firms invest in high-potential startups in exchange for equity. VCs typically get involved in later stages (post-seed or Series A) and provide more substantial funding to help startups scale.

-

Crowdfunding: Platforms like Kickstarter, Indiegogo, or GoFundMe allow entrepreneurs to raise money from a large number of people, often in exchange for pre-orders, equity, or rewards.

-

Bank Loans and Government Grants: Traditional bank loans or government grants can provide funding with fixed terms and interest rates. These options may be harder to obtain without a proven track record or solid collateral.

-

Accelerators and Incubators: These programs provide startups with funding, mentorship, office space, and resources to help them grow. In exchange, startups often give up a percentage of equity.

Key Tips for Securing Startup Funding

-

Start with a Solid Business Plan

A clear and compelling business plan is the first step in attracting investors and securing funding. Investors want to understand your business model, target market, financial projections, and growth strategy. A well-crafted business plan should include:

- Executive Summary: A concise overview of your business, including your vision, mission, and value proposition.

- Market Research: Detailed research on your industry, target customers, and competitors to demonstrate your understanding of the market landscape.

- Revenue Model: How your business will make money and the pricing strategy.

- Financial Projections: Estimated revenue, expenses, cash flow, and profit for the next 3-5 years.

- Milestones and Goals: Specific milestones you plan to achieve and a timeline for accomplishing them.

Having a strong, data-backed business plan shows potential investors that you’ve done your homework and are prepared to take your business to the next level.

-

Understand Your Funding Needs

Before seeking funding, determine how much capital you actually need and what you will use it for. Having a clear financial need helps you focus on the right type of funding and gives investors confidence that you know how to allocate resources effectively.

Ask yourself:

- How much capital do I need to reach my next milestone?

- What will the funds be used for (e.g., product development, marketing, hiring)?

- What is the expected return on investment (ROI) for each stage of funding?

Providing clear answers to these questions will make your pitch more compelling to investors.

-

Know Your Funding Sources

Different investors have different risk appetites, expectations, and investment horizons. Understand the characteristics of each funding source and tailor your approach accordingly.

- Angel Investors: Ideal for early-stage startups with innovative ideas but limited traction. Angels tend to invest in passionate founders and new technologies.

- Venture Capitalists: VCs typically look for high-growth companies with a scalable business model and a proven track record. They expect a significant return on investment (ROI) and may want a more hands-on role in managing your company.

- Crowdfunding:https://forum-k.biz/ is an excellent choice if you have a product that can generate excitement among a large audience. It’s often used consumer-focused startups or those with a strong social component.

- Government Grants: Certain industries, like technology or healthcare, may have access to government grants and subsidies. Research the grants available in your industry and region.

Understanding which funding sources are appropriate for your business stage and type will help you focus your efforts and make a more targeted pitch.

-

Craft a Compelling Pitch

Investors often receive hundreds or even thousands of pitch decks, so it’s essential to make yours stand out. A well-crafted pitch should clearly explain the problem your business solves, why your solution is unique, and how you plan to execute your vision.

Key components of a successful pitch:

- Elevator Pitch: A brief, impactful summary of your business that can be delivered in under a minute. This is the hook that will grab investors’ attention.

- Problem and Solution: Clearly articulate the problem you’re solving and how your product or service uniquely addresses it.

- Market Opportunity: Demonstrate the size and growth potential of your target market.

- Team and Expertise: Highlight the strengths of your team and why you’re uniquely positioned to succeed.

- Financials: Share your financial projections, funding needs, and expected ROI.

- Exit Strategy: VCs and angel investors will want to know how they can eventually exit the investment (e.g., acquisition or IPO).

Keep your pitch clear, concise, and persuasive. A well-thought-out pitch can go a long way in impressing potential investors.

-

Show Traction and Proof of Concept

Investors want to see that your startup is more than just an idea. Demonstrating traction (such as early customers, revenue growth, or user engagement) increases your credibility and makes it easier to raise funds. This can include:

- Customer Testimonials: Positive feedback from early customers that show demand for your product.

- Revenue and Growth Metrics: Show how your business has grown over time in terms of revenue, users, or engagement.

- Product Prototypes or MVPs: If your product is still in development, showcasing an MVP (Minimum Viable Product) or prototype can help demonstrate your ability to execute.

Traction proves to investors that your idea has potential, making it easier for you to secure funding.

-

Be Prepared for Due Diligence

When you attract potential investors, they will likely conduct a due diligence process to assess your startup’s financial health, legal standing, and business operations. Be ready to provide all necessary documentation, such as:

- Financial Statements: Profit and loss statements, balance sheets, and cash flow statements.

- Legal Documents: Company incorporation documents, intellectual property agreements, and contracts with customers or suppliers.

- Team Backgrounds: Information on your leadership team, including resumes and relevant experience.

Being transparent and organized during the due diligence process builds trust and increases your chances of securing funding.

-

Consider the Terms of Investment

Every funding source comes with its own terms and conditions, so it’s important to understand what you’re agreeing to. When negotiating with investors, consider:

- Equity vs. Debt: Angel investors and venture capitalists typically take equity in exchange for funding, while loans or convertible notes involve debt. Understand the implications of giving up equity and how it affects your control over the business.

- Valuation: The valuation of your business will influence how much equity you’ll need to give up. It’s crucial to understand how investors will value your business and negotiate for a fair deal.

- Investor Control: Some investors may want a say in decision-making or may request board seats. Be clear on the level of control they will have over your business.

- Exit Strategy: Ensure that you and your investors are aligned on the business’s exit strategy, whether it’s through an acquisition, IPO, or other means.

It’s always a good idea to consult with legal and financial advisors before signing any investment agreements.

-

Leverage Networks and Mentorship

Networking with other entrepreneurs, investors, and industry experts can provide valuable insights and connections that help you secure funding. Attend startup events, pitch competitions, and networking meetups to meet potential investors and mentors who can guide you through the funding process.

Having a mentor with experience in startup funding can provide valuable advice on where to find the right investors and how to navigate complex negotiations.

Conclusion

Securing funding for your startup is a critical step in transforming your business idea into a reality. By developing a strong business plan, understanding your funding options, crafting a compelling pitch, and demonstrating traction, you can increase your chances of attracting the right investors. Remember that startup funding is not just about money—it’s about building long-term relationships with investors who share your vision and can help your business grow.

Whether you’re starting small with bootstrapping or aiming for a large venture capital investment, having a clear strategy and being well-prepared will give you the best chance of success in securing the capital you need to take your startup to the next level.